Funding for life science startups is vital for research, development, and growth, yet it poses complex challenges. Funding plays a role in driving startups, particularly in industries like life sciences companies that require substantial capital. Acquiring funding is essential for life science startups as they strive to carry out research, develop innovative products, recruit top-notch professionals, navigate regulatory landscapes, and ultimately bring advancements to the market.

However, obtaining startup funding is not a task. Entrepreneurs in the life sciences industry face challenges when it comes to sourcing and securing the necessary capital at various stages of their growth.

The Importance of Funding for Startups in the Life Sciences

Why is Funding Particularly Critical for Life Science Startups?

To begin with transforming concepts into commercially available drugs, devices and therapies involves lengthy and expensive research and development (R&D) processes. The journey from laboratory experiments to product launch can often exceed a decade in the pharmaceutical and biotechnology sectors. Developing a drug on average costs around $1 billion.

Conducting lab research, meeting stringent regulatory requirements and expanding manufacturing capabilities all demand significant financial resources. Bootstrapping is generally not feasible for startups engaged in drug discovery, biotechnology, or medical devices.

Moreover, apart from R&D activities, funding plays a role in attracting top-tier talent. Building teams necessitates the involvement of specialized researchers, clinicians with expertise in their respective fields, regulatory experts, with deep domain knowledge, and experienced leaders.

For instance, for large pharmaceutical companies to support the experts in the field it is crucial to provide compensation, necessary resources such as labs and equipment, and sufficient capital. Having funding also helps navigate the complex regulations surrounding clinical trials, quality compliance, patient privacy, and more with the guidance of experienced advisors. Unfortunately, many promising startups struggle to secure investment.

This blog aims to dive into the funding landscape for life science startups and offer strategies for obtaining the necessary financing to develop innovative solutions that can save lives. Specifically, we will explore the various stages of funding that life science startups typically go through.

- Both are alternative sources of capital.

- Effective preparation for approaching investors.

- Crafting a pitch and negotiating favorable terms.

- Building relationships with investors after securing funding.

- Emerging trends in startup funding within the life sciences sector.

By understanding the intricacies of securing capital and implementing practices in accessing funds entrepreneurs can avoid potential pitfalls and position their companies for success. Although the journey from an idea to a transformative medical product is challenging, having adequate funding significantly enhances its feasibility. Let’s dive into how startups can obtain the fuel to revolutionize healthcare and advance human health.

Understanding the Funding Landscape

Securing funding is a milestone for every life science startup. The financial needs and available sources change as the company grows.

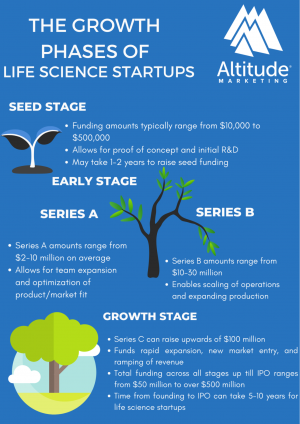

Seed Stage

During this phase, startups focus on validating their core concept and technology. They conduct research and development, gather feedback from the market, determine regulatory pathways, and build their founding team.

As major expenses related to product development and commercialization have not yet started funding requirements are relatively low at this stage. Most seed funding rounds raise more than $2 million. Common sources of funds include the finances of founders, support from friends and family networks, angel investor contributions, government grants as well as awards, from business plan competitions or accelerators.

Series A

After proving feasibility companies raise Series A rounds to fully develop their products and achieve initial product market fit. The funds raised during this round typically range from $2 million to $15 million. This allows startups to complete R&D activities, initiate filings, generate clinical data, and significantly expand their team.

Series A funding rounds are typically led by venture capital firms that focus on supporting early-stage life science startups.

Series B

Once a startup has completed its Series A round it can utilize Series B funding to scale up its operations and accelerate growth. The amount raised in Series B, which ranges from $10 million to $30 million is used for purposes such as expanding manufacturing capabilities, conducting extensive product testing and clinical trials, strengthening sales and marketing efforts entering new markets, and making essential infrastructure investments.

In some cases, the lead investors in Series B are often the same venture capital firms that were involved in previous rounds.

Series C and Beyond

Moving beyond Series B startups enter later-stage funding rounds like Series C and beyond. During these stages mature startups aim to raise capital of usually $50 million or more to facilitate rapid company expansion.

The primary focus is on growth across different areas such as manufacturing capacity, distribution networks, sales channels, clinical trial activities, product line expansions, and geographical reach. Participants in these later-stage funding rounds can include late-stage VC, biotech venture capital firms themselves, private equity firms, and bank entities.

Startups need to understand the sources of funding available to them at different stages of their growth journey. This knowledge allows them to strategically pursue the types and combinations of capital that align with their growth phase while still maintaining an optimal level of control.

Preparing for the Funding Journey

Before approaching investors for funding opportunities it is crucial for startups to thoroughly prepare themselves across all aspects of their business operations. This includes positioning themselves and ensuring they have a comprehensive understanding of their market landscape.

Here are the key steps to consider:

Company Stage | Employee Size | Preparation Checklist |

Pre-revenue startup | Pre-revenue | 1. Develop strong business plan |

Early stage | <10 employees | 1. Create a thorough pitch deck |

Growth stage | 10-50 employees | 1. Develop 5-year financial projections |

Mature stage | >50 employees | 1. Ensure rigorous regulatory compliance |

1. Creating an Engaging Business Plan

A crafted business plan is crucial when seeking funding. It should include the following elements:

Executive Summary: A concise overview of your business opportunity product/technology solution, target market, competitive advantages, growth strategy, and funding requirements.

Market Analysis: An assessment that demonstrates a significant and growing demand for your proposed product or technology. This should include data on market size, growth trends, and buyer pain points.

Product Details: An in-depth description of your product, technology, or therapy. Clearly explain how it addresses buyer needs better than existing solutions.

Revenue Model And Projections: Provide an explanation of how you will generate revenue and present realistic financial projections for at least five years. Make sure to include assumptions.

Management Team: Highlight the backgrounds of founders and key executives emphasizing their experience and achievements. Additionally, showcase any advisors or board members.

2. Establishing a Strong Team

Investors attach importance to the team behind a startup. An ideal founding team combines business acumen with industry expertise, technical skills, and perseverance. As your company grows, focus on strengthening your team by adding advisors and executives with capabilities in areas such as operations, regulatory affairs, clinical expertise, finance management, and marketing. Being able to attract top-notch talent demonstrates your credibility.

3. Understanding Market Dynamics and Competition

Conduct market research and analysis to understand the dynamics of the market and your competition. By doing so you can gain a full understanding of the needs, buying criteria, and how your solution meets those demands in a unique way.

Analyzing what your competitors offer will also help you position your product effectively and implement marketing services that set you apart. Utilizing data will enable you to determine the size of the target market and identify growth opportunities.

4. Protecting Intellectual Property

Protecting property (IP) is crucial for increasing the valuation of your startup and safeguarding your competitive position in the market. Make sure to file accurate and comprehensive patent claims that cover aspects of your technology or therapy. Additionally, it’s important to protect any branding, content, or other IP assets.

5. Navigating Regulatory Requirements

To navigate requirements successfully seek expert advice to identify and comply with all relevant regulations, testing procedures, reporting obligations, and compliance requirements. Products like drugs or devices outline a preclinical and clinical timeline that explains how your innovation will progress from testing to being available on the market.

Take these considerations into account when projecting financials and determining funding needs for each of the early-stage companies. Once these core elements are thoroughly addressed you’ll be well prepared for discussions related to funding.

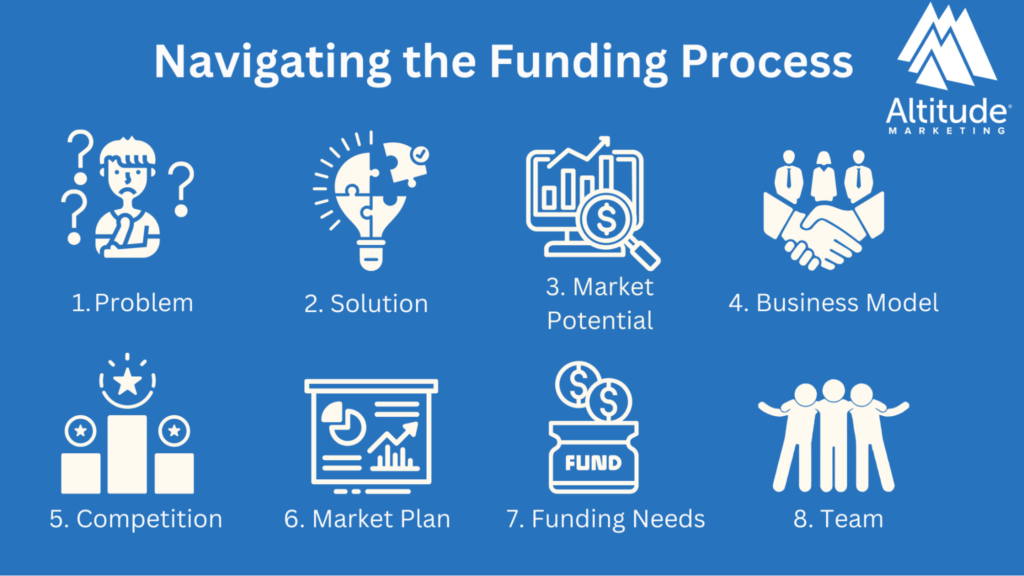

Navigating the Funding Process

Navigating through the funding process involves creating a pitch deck and delivering a compelling verbal presentation that leaves a positive first impression, on potential angel investors. To capture interest provide an overview of the following points:

1. Problem: Clearly explain the specific pain point or unmet market need that your startup addresses. Support your explanation with data to quantify the issue and emphasize its urgency.

2. Your Solution: Describe your product, technology, or service in detail. Highlight its features and explain how it solves the problem in unique ways that existing solutions fail to achieve.

3. Market Potential: Quantify the size of the addressable market for your solution using robust data. Showcase any growth trends that make this market appealing.

4. Business Model: Elaborate on how you plan to generate revenue and make a profit. Discuss your pricing strategy revenue streams and projected profit margins.

5. Competition: Outline the competing solutions in the market. Highlight how you differentiate yourself from them based on factors such as features, technology, business model, etc.

6. Go to Market Plan: Provide an overview of your strategies for acquisition, marketing, sales, and distribution.

7. Funding Needs: Specify the amount you are seeking to raise and outline milestones that this funding will help you achieve. Additionally, explain how you plan to scale with future funding opportunities.

8. Team: Introduce members of your team along with their relevant experience and notable accomplishments.

Networking and Relationship Building

Leverage your network connections to establish relationships with individuals and firms specializing in life science startup investments.

Actively participate in industry conferences and events to expand your network.

Nurture relationships with investors through regular communication, over time.

Due Diligence and Deal Negotiation

When going through the diligence process and negotiating deals it’s important to be prepared to provide a substantial amount of documentation. This includes information, intellectual property portfolios, pipelines, market studies, and prototype demonstrations. It’s crucial to have an understanding of valuation methodologies and the intricacies of term sheets to negotiate effectively.

Back up your valuation expectations with market data and evidence of traction. Discuss deal terms related to equity dilution, voting rights, and considerations for founders.

Managing Investor Relationships

Once funding is secured it’s important to maintain relationships with investors. Keep them updated on your progress and share insights into key milestones that have been achieved. Be transparent about any challenges you may be facing. Continue to engage with investors for their connections and guidance so they feel like partners in your startup’s growth journey.

Successfully navigating these elements can help change a NO into a YES from investors.

5 Alternative Funding Strategies

In addition to venture capital and equity financing options, life science entrepreneurs have other creative alternatives for funding their ventures. One such option is bootstrapping, which involves relying on resources such as the personal finances of the founders themselves or revenue generated by the company.

1. Bootstrapping

The main advantage of bootstrapping is that it allows entrepreneurs to retain ownership and control over their start up without diluting equity by bringing in outside investors. However, it’s worth noting that bootstrapping may not be suitable for startups, with research and development expenses or infrastructure needs as it has limitations when it comes to scalability.

It is suitable for supporting early-stage development such as building Minimum Viable Products (MVPs). It does not offer enough capital for lengthy clinical trials or extensive commercial expansion.

Bootstrapping works well for startups that have business models requiring assets and can generate revenue from the beginning. However, most biotech and medtech companies still require some funding. Bootstrapping can be a supplementary strategy in such cases.

2. Non-Dilutive Financing

Non dilutive financing options, like debt instruments and revenue-based financing, provide capital without the need to exchange any equity. Debt instruments include bank loans, convertible notes, and lines of credit. Startups need to demonstrate their ability to repay these obligations. Revenue based financing raises capital by sharing a portion of revenue over a fixed period instead of exchanging equity.

The main advantage is that founders maintain control over their company without the fear of dilution. However careful evaluation of payback terms and amortization schedules is necessary. Startups should have confidence in achieving revenue milestones.

When strategically utilized between equity rounds, nondilutive capital offers flexibility to continue operations and achieve risking milestones leading to stronger valuations, in subsequent rounds.

3. Crowdfunding

Crowdfunding involves raising amounts of capital from a large number of individuals through online platforms. Sites like Kickstarter and Indiegogo have revolutionized the way startups connect with backers around the globe.

When it comes to life science startups crowdfunding serves as a tool for creating initial brand awareness and gauging interest rather than solely relying on raising significant capital. Typically crowdfunding campaigns manage to secure amounts under $1 million, which may not be sufficient for startups involved in research and clinical trials.

However, crowdfunding can still offer benefits such as generating market traction, gaining media visibility and gathering insights. In cases like social enterprises or medical device startups it can even supplement other funding sources by involving end user communities. Nonetheless for biotech and pharma startups crowdfunding utility tends to be limited primarily to the early stages of development.

The key lies in assessing the advantages and disadvantages relative to a startups industry, stage of development, and objectives. By utilizing crowdfunding alongside other approaches it can effectively complement a startups funding strategy.

4. Strategic Partnerships

Forming partnerships with corporations, venture capitalists, research institutions, medical centers or healthcare providers can provide startups with essential funding opportunities along with access to valuable resources and industry expertise.

For instance, collaborating with a leading hospital grants access to facilities/equipment as well as patient populations necessary for conducting trials. Similarly beneficial is partnering with an established pharma company that allows leveraging their R&D capabilities while utilizing their supply chain infrastructure and regulatory experience.

Nevertheless entering into partnerships entails relinquishing some decision-making authority in areas that pertain to the collaboration. Prospective partners conduct thorough diligence necessitating startups to showcase adherence to regulations and favorable data.

When properly aligned with a startup’s goals strategic partnerships have the potential to expedite development and commercialization. However, it is crucial to consider the trade offs in terms of control and economic implications.

Real World Example:

In 2022, Amgen and Horizon Therapeutics announced a strategic collaboration to jointly develop and commercialize. It seems the two companies announced a collaboration to develop and sell a drug called teprotumumab, which is being studied for autoimmune diseases.

Amgen paid Horizon $26.5 million upfront and could pay up to $260 million more if certain development and sales goals are met down the line. The companies are going to sell teprotumumab together in the U.S. and split any profits, while Amgen gets to sell it outside the U.S. on its own.

5. Public Funding Programs

Federal and state governments offer a plethora of grants, loans, tax incentives, research grants, and subsidies to support life science startups, especially in strategic areas like biotech R&D, orphan drugs, pediatric therapies, infectious diseases, etc.

For example, the NIH provides over $1 billion annually to startups through the SBIR/STTR programs. Funding for grant programs is awarded based on rigorous proposal evaluations and awardees must comply with reporting requirements.

While federal grants are extremely helpful, government funding usually cannot sustain a startup throughout its lifespan. These programs involve lengthy applications and intense competition, so startups must evaluate if public funding is aligned with their development needs and objectives.

Assessing how and when to leverage these alternatives allows startups to fund their ventures creatively while optimizing ownership and control.

Industry Funding Trends

Despite ongoing market volatility, the life sciences sector continues to attract robust investment interest, reflecting its tremendous growth prospects.

1. Soaring Funding Levels

In 2020, despite the economic uncertainty of the pandemic, global venture capital funding into life science startups exceeded $80 billion. North American and European biotech companies raised record amounts, while Asia experienced a massive 145% growth in funding for life science startups compared to 2019.

2. Biotech Boom

Biotechnology has been the hottest area within life sciences for VC investments. Total biotech funding reached $38 billion globally in 2020. Highlights within biotech sector include:

- Moderna raised the largest biotech IPO ever, over $1.5 billion, due to its COVID-19 vaccine development.

- Several late-stage biotech startups like Sana Biotechnology and Relay Therapeutics completed mega-rounds above $500 million.

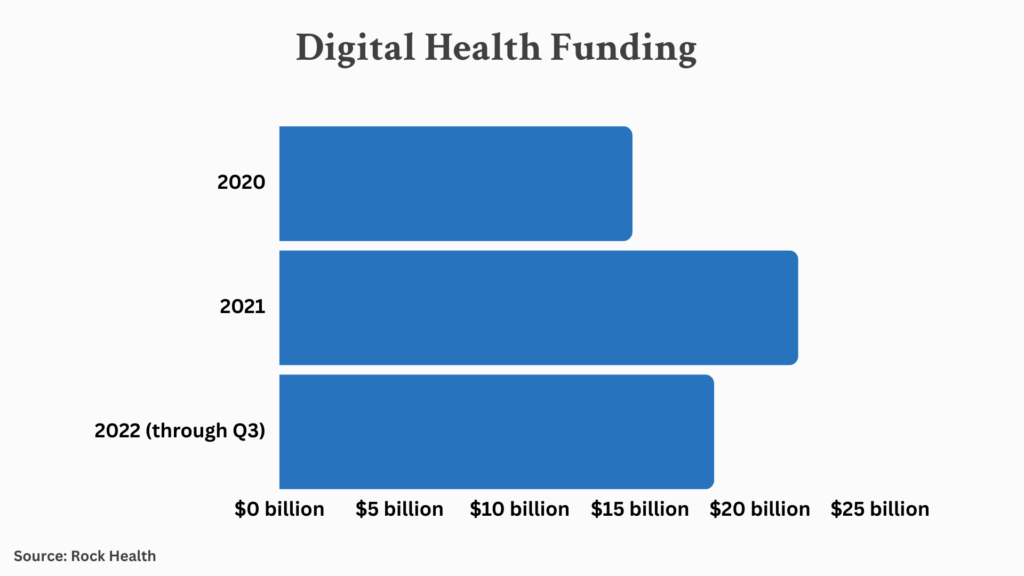

3. Digital Health Expansion

Startups leveraging digital technologies for telehealth, personalized medicine, AI diagnosis, remote monitoring, and data analytics are surging in funding. Global digital health funding grew 19% to reach $21 billion in 2020.

4. Globalization of Funding

While North America accounts for over 70% of financing, Europe and Asia are rapidly ramping up investments in life science startups. This spread of funding hotspots provides more options to startups worldwide.

5. Corporate Venture Capital

Pharmaceutical giants like Merck, GSK, Novartis, and Johnson and Johnson have launched multi-billion dollar corporate venture funds to invest into innovative startups. This is providing new strategic financing avenues for the biotech industry.

Analyzing the latest investment data from leading sources like CBInsights, Pitchbook, and Crunchbase can uncover more granular geographic, sectoral, and company stage trends.

Frequently Asked Questions

What metrics do investors look for in life science startups?

Key metrics investors look for include clinical trial results proving efficacy and safety, clear IP protection and licensing strategy, size of the total addressable market, reimbursement potential, key talent and expertise within the team, scientific and operational milestones, and demonstrated progress along regulatory approval pathways.

How can life science entrepreneurs expand their investor network?

Strategies include attending healthcare startup events and conferences, leveraging accelerator/incubator connections, seeking introductions from board members and advisors, engaging with pharma and biotech investors and companies, and actively networking with VC firms focused on life sciences.

When is the right time to start discussing potential exit opportunities with investors?

Broach exit strategy possibilities early when establishing investor relationships, even if planning to remain private long-term. This aligns expectations and allows more flexibility later on. Be cognizant of motivations, PE firms have shorter hold periods than VCs.

Conclusion

Life science startups operate in a complex, high-stakes environment. With scientific rigor, regulatory obligations, and steep capital needs, the margin of error is low. Securing adequate funding is make or break, enabling startups to hire exceptional talent, conduct robust research, achieve product-market fit, and scale successfully.

While the funding process can be daunting, preparation, persistence, and creative thinking can help life science entrepreneurs raise the fuel they need to transform ideas into products that save lives and advance human health.

The life science funding landscape will continue evolving. But by staying agile and leveraging the strategies outlined above, startups can adapt and thrive in this dynamic sector. The opportunities for meaningful innovation have never been greater.

Ready to elevate your B2B marketing?

We help leading business-to-business brands hit their marketing goals. Get in touch to learn how Altitude Marketing can help you reach your peak performance.