B2B Customer Lifetime Value (CLV) is greatly enhanced by nurturing relationships with existing clients rather than focusing primarily on attracting new customers.

According to Forrester, there is a 60-70% probability of making a sale to a current B2B customer, whereas the likelihood drops significantly to just 5-20% when dealing with new prospects. This emphasizes the crucial need to prioritize strategies that focus on customer retention and loyalty in order to drive growth.

Businesses can maximize repeat sales through organic upsells and cross-sells by improving the customer experience and fostering loyalty with established clientele. Investing in current B2B customers improves their lifetime value and sustains long-term profitability much more efficiently than acquiring new customers. Success starts with a targeted, personalized, and engaging marketing strategy that deepens the trust you already have with your existing client base.

How to Measure and Improve B2B Customer Lifetime Value

Why Should You Focus on Improving CLV?

Optimizing customer lifetime value (CLV) is crucial in maximizing the revenue potential of your B2B customer accounts. CLV represents the economic value during a customer lifespan that a business can anticipate from an average customer relationship encompassing initial purchases to potential renewals. By tracking CLV you can:

- Identify your valuable customer segments

- Accurately assess pricing strategies

- Effectively allocate marketing budgets

- Structure incentive programs

- Prioritize retention campaigns

Companies with higher customer lifetime values experience, on average, 38% faster revenue growth and 30% higher enterprise valuations compared to their competitors (according to McKinsey). This correlation illustrates the importance of prioritizing customer satisfaction and cultivating a valuable customer base in the B2B sector. Let’s dive into methods you can use to measure CLV.

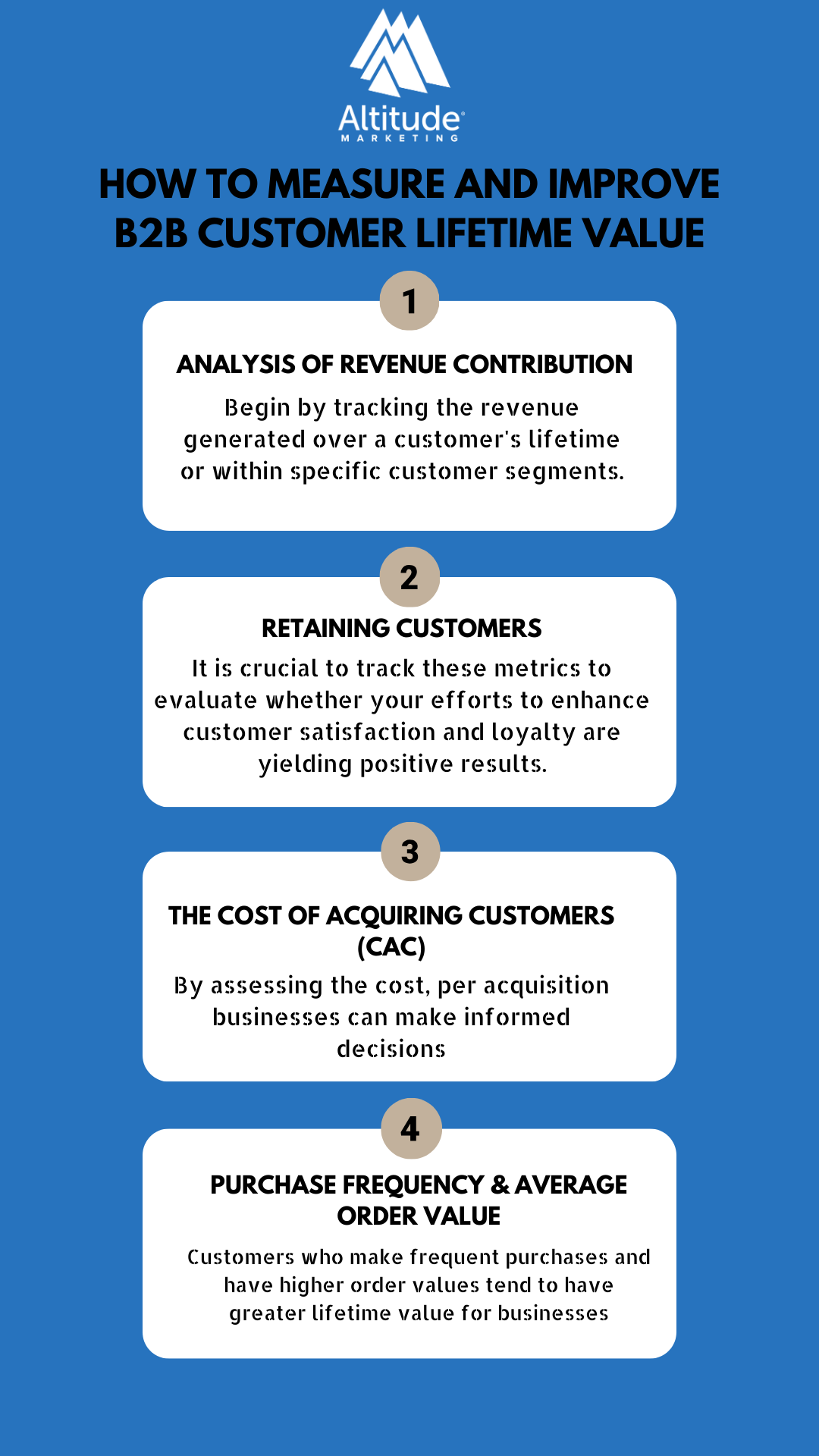

Essential Indicators for Measuring B2B CLV

1. Analysis of Revenue Contribution

Begin by tracking the revenue generated over a customer’s lifetime or within specific customer segments. This analysis will reveal:

- Customers with the highest lifetime value

- Customers with the lowest lifetime value

- Average CLV across different segments

In most businesses, roughly 80% of total revenue is driven by the top 20% of customers following the Pareto principle. Identifying these ” few” top-tier accounts that contribute to a majority of sales is crucial. You can then focus on retaining these high-lifetime value customers and implementing strategies to enhance their loyalty and advocacy.

Conversely, recognizing segments with profitability enables you to evaluate whether it’s worthwhile to invest further in acquiring similar profiles. You may even consider adjusting product offerings or pricing models if certain customer groups demonstrate profitability.

Best Practice Example: A software leader like Oracle assigns a Customer Lifetime Value Rating to each client account. This looking metric estimates future lifetime value based on factors such as contract value, renewal rates and potential advocacy. Sales teams can then tailor their engagement strategies according to customer tiers, ensuring higher satisfaction and fostering CLV growth.

2. Retaining Customers

When we analyze the rate at which customers stay with us or leave us within a period it gives us valuable insights into customer retention. This measurement is typically done on a year-over-year basis and a higher retention rate directly translates to customer lifetime value.

Research conducted in the industry suggests that even a small increase of 5% in customer retention can lead to profit growth ranging from 25% to 95% as reported by Bain & Co. This clearly indicates the importance of prioritizing initiatives aimed at boosting customer retention.

To measure customer retention effectively, there are some metrics that can be used:

- Customer Retention Rate: This percentage represents the number of customers who remain with your business over a defined period.

- Churn Rate: This percentage reflects the number of customers lost during a timeframe.

It is crucial to track these metrics to evaluate whether your efforts to enhance customer satisfaction and loyalty are yielding positive results.

One example: CSG International, which provides business support solutions for Fortune 500 brands, effectively utilizes analytics across various customer touchpoints. By identifying usage patterns, they can predict churn risks and take timely actions to improve customer retention.

3. The Cost of Acquiring Customers (CAC)

Calculating the cost per acquisition involves considering all expenses incurred in acquiring customers. These expenses include:

- Marketing costs (advertisements, events, content creation, etc.)

- Sales costs (lead nurturing product demos/trials, negotiations, etc.)

By assessing the cost per acquisition, businesses can make informed decisions regarding their marketing and sales strategies while ensuring efficient use of resources.

Afterward, make sure to compare your customer acquisition cost (CAC) with the customer lifetime value (CLV) metrics mentioned above. It’s important to ensure that your acquisition investments are generating returns.

Ideally, your CLV should be 3-5 times higher than your CAC in order to achieve a return on investment. If your CAC is too high, it would be wise to reevaluate your marketing channels and sales processes. Optimizing conversion rates and reducing expenses can help bring down the CAC.

Let’s take a best practice example from UPS, a logistics giant. They have a team that utilizes data mining and analytics to control their CAC. By identifying the touch points that drive the number of conversions, they optimize their lead generation processes. As a result of their efforts in optimizing CAC, they have directly increased the profitability of acquiring business clients.

4. Purchase Frequency & Average Order Value

Average purchase frequency and average order value (AOV) provide insights into ongoing purchase patterns:

- Purchase frequency: This indicates how often individual customers make transactions.

- Average Order Value (AOV): This refers to the amount spent per transaction.

Customers who make frequent purchases and have higher order values tend to have greater lifetime value for businesses. For example, clients who invest in memberships, subscriptions or managed services involving recurring payments generally exhibit higher retention rates. SaaS companies with automated recurring billing systems retain subscribers over seven times longer than those relying on renewals (Roivenue). The frequency of transactions and the size of orders often directly correlate with increased customer lifetime value.

When it comes to boosting customer lifetime value (CLV), exploring pricing models that encourage repeat purchases rather than one-time sales can present a great opportunity.

4 Strategies for Improving CLV of B2B Customers

Here are four strategies that have proven effective in improving CLV for B2B customers:

1. Building Strong Emotional Connections

Loyalty is nurtured through relationships and positive brand sentiment. According to Salesforce, over 57% of B2B customers choose solution providers that truly understand and address their needs.

Businesses that can demonstrate genuine empathy are able to reinforce shared values, cultivate trust, and inspire strong advocacy from their customers. It’s important to highlight industry expertise and authority to enhance credibility.

Customers who feel emotionally invested in your brand tend to be five times more loyal on average. To prioritize human-centric engagement, make sure you:

- Resolve issues promptly

- Continuously seek feedback

- Personalize your communication

- Recognize loyalty milestones

- Connect with customers on a peer level

Consider assigning account managers or customer success representatives as single points of contact for high-lifetime value customers. This approach helps build rapport and accelerates issue resolution. Enhancing customer retention.

For instance, adopting sales approaches that focus on co-creating solutions tailored to the explicit needs of your clients tends to yield better results than product-focused pitches. By prioritizing customer centricity and emphasizing shared goals, you can foster trust and loyalty among your clientele.

Around 82% of B2B clients who have account representatives tend to renew their contracts compared to 58% without such representatives.

2. Launch Loyalty Programs

Another effective strategy to foster loyalty is to launch loyalty programs that offer incentives for repeat purchases. Some traditional options include providing volume discounts for orders waiving delivery fees for repeat purchases offering cashback based on annual spending thresholds and granting access to exclusive resources like webinars, early product releases, and priority support queues.

3. Identify Upsell and Cross-sell Opportunities

To further boost customer lifetime value, it’s important to identify cross-sell opportunities. By analyzing customers’ past purchase patterns, you can recommend add-ons that align with their specific needs. For example, if a client typically buys your SaaS platform along with premium support and backup services, you can highlight the value of additional modules such as analytics, automation tools, or security features. Educating customers about the range of solutions related to their goals will also enable contextual upsell suggestions and drive higher adoption rates.

Cross-selling is another avenue for CLV growth. This involves promoting products or services from your portfolio that are new but still relevant to existing customers. For instance, an accounting platform provider could cross-sell payroll management software to clients who are already using its invoicing solution. Similarly, a CRM vendor could emphasize its customer service module to subscribers of its marketing automation tools.

By utilizing information obtained from customers’ previous orders, product usage patterns and account data, businesses can identify customer preferences before suggesting products or services. This approach increases customer engagement due to the timing and perceived value of the recommendations.

According to McKinsey, effective cross-selling strategies can lead to a profit increase of over 20% by expanding the share of customers’ wallets.

4. Harness the Power of CRM Platforms

Customer Relationship Management (CRM) platforms offer centralized databases that store all customer interactions across departments and channels. They also integrate with billing systems, service ticketing systems, marketing automation tools, sales systems, and fulfillment systems to provide a view of each client.

Additionally, CRM platforms provide analytics dashboards that track drivers of customer lifetime value (CLV), such as purchases, renewals, referrals, and engagement metrics. AI-powered predictive modeling can also help identify churn risks. The promotional messaging and lead nurturing workflows within CRM platforms are customizable based on factors like client industry, deal size, and growth potential.

Companies that leverage CRM systems experience a growth rate three times faster than those that don’t, according to SuperOffice. This is achieved by enabling personalized and relevant customer experiences.

For instance, integrating CRM data with chat and helpdesk platforms allows support agents to access real-time purchase histories. This enables them to provide tailored solutions or suggest products/services during service inquiries—thus enhancing customer satisfaction levels and increasing order values.

Real Life Examples of B2B Customer Lifetime Value (CLV) Optimization

Prominent players in the industry who are redefining client engagement through innovative marketing strategies to maximize CLV include:

1. HubSpot - Empowering Customers through Self Service and Education

HubSpot, a marketing platform, empowers its customers by providing educational blog articles, instructional videos and searchable knowledge bases.

By enabling users to find answers, it reduces the need for support tickets for basic issues.

Furthermore, the comprehensive content helps educate customers on how to derive value from HubSpot products. This indirectly leads to continuation rates as clients realize the full range of potential use cases.

According to industry research, allowing customers to self-educate results in a retention rate that is 25% higher. The ability to resolve issues without direct sales team intervention also strengthens customer independence and trust.

2. Amazon Web Services - Prioritizing Customers

As a leader in cloud infrastructure, Amazon Web Services (AWS) emphasizes the importance of understanding its customers in order to earn their trust.

They gather feedback from customers through surveys, interviews and site analytics. AWS follows a customer obsession approach known as “Working Backwards,” starting with understanding customer needs rather than focusing solely on what they can provide.

By identifying pain points and resolving issues even before clients recognize them, AWS builds significant goodwill. Teams across AWS collaborate regularly to brainstorm ways of serving their customers on a daily basis.

This intense focus on prioritizing customer needs has directly contributed to their dominance in the industry.

3. DXC Technology – Enhancing Personalization at a Scale through Data Integration

DXC Technology, a global IT services firm faced challenges where client relationships were managed separately by different business units resulting in disconnected experiences due to limited collaboration among sales, services, and support teams.

To address this issue they implemented an integrated Customer Relationship Management (CRM) solution. This allowed them to have a comprehensive view of interactions across various regions and departments. By utilizing AI-powered analytics they gained behavioral insights that enabled them to personalize engagements on a granular level. As a result, they experienced an increase of over 25% in Customer Lifetime Value (CLV) within just one year.

Furthermore, the ability to measure touch attribution provided insights into how every marketing action impacted revenue. This enhanced their strategy’s Return on Investment (ROI). DXC continues to enhance CLV by refining models and aligning messaging with the Next Best Actions based on customer behavior.

Additional Strategies for Advanced CLV Optimization

Now lets explore some approaches that large corporations adopt to further maximize CLV.

1. Implementing Predictive Analytics

By utilizing statistical predictive modeling and machine learning algorithms organizations can accurately forecast various drivers of CLV with exceptional precision.

There are types of predictions that can be made including:

1. Understanding customer behavior: This involves identifying patterns that indicate the frequent and valuable orders made by customers.

2. Predicting churn probability: It helps to quantify the likelihood of customers not renewing their subscriptions or services, allowing for interventions.

3. Forecasting customer lifetime value: This helps gauge the expected value a customer will bring over their relationship with a company, which can guide sales prospecting and marketing efforts.

4. Providing recommendations for best actions: These suggestions aim to offer contextual upselling and cross-selling opportunities to each individual client.

5. Evaluating touch attribution: This determines which marketing channels and campaigns contribute the most to driving conversions.

By detecting warnings of potential churn or opportunities to enhance customer lifetime value, companies can take proactive measures to both retain customers on these accounts and reduce attrition rates.

Tailoring messaging based on purchase predictors also leads to better campaign performance. Optimized models support data-driven decision-making across various teams, such as sales, marketing, service, and product.

For instance, Adobe uses propensity modeling techniques to calculate “likelihood to buy” scores, enabling them to identify prospects who are more likely to purchase specific offerings. Aligning targeted promotions with this segmentation maximizes the impact, in solution areas.

2. Performing Churn Analysis

It is equally important to analyze the reasons behind customer losses. You can research churn drivers by:

- Transactional surveys: Ask customers who have resigned about the factors that influenced their decision to discontinue using your services.

- Service call drivers: Identify themes among unsatisfied accounts by analyzing the main reasons for customer complaints or issues.

- Market dynamics analysis: Recognize the impacts of pricing sensitivity and competitor activity that may be affecting churn in your market.

These qualitative insights complement models that identify accounts at risk of turnover. For instance, if there is an increase in cancellations from small businesses to consumer customers, it could indicate affordability issues. In cases, adjusting pricing models can help mitigate churn.

Alternatively, you can launch customer feedback forms for subscribers to measure satisfaction levels on critical performance aspects like support responsiveness or solution functionality. This allows you to take corrective actions and prevent customer attrition.

Netflix, for example, performs analytics to attribute cancellations to factors such as price adjustments or content changes. This guides their strategy planning for optimized customer retention.

3. Adopting Robust Customer Segmentation

Not all customers hold value nor do they have similar needs and priorities. By subdividing your clientele into defined categories you enable personalized engagement strategies.

While there are variables that can factor into profile clustering some common dimensions include:

- Industry vertical

- Company size

- Purchase history

- Growth potential

- Relationship stage

- Loyalty tier

- Tech sophistication

- Decision-making authority

A simple example would be grouping customers based on their industry. Assigning industry-specific account managers to them. This facilitates contextual dialogue grounded in domain expertise and helps establish trust more quickly.

Sophisticated techniques in machine learning are utilized to analyze a range of customer data fields and generate highly targeted segments automatically. This allows for customization of messaging, offers and product recommendations that enhance relevance for each group.

Amazon’s unwavering focus on understanding every aspect that impacts the customer experience has resulted in the creation of over 500 million product categories on its platform. This ability to personalize on a large scale fuels recommendation engines, leading to increased conversions and larger order values by catering to individual interests.

Conlusion: Prioritize Customer Lifetime Value

While pursuing business is important for growth, securing repeat purchases from existing accounts holds much greater potential in B2B settings. Loyal clients also tend to refer leads through word of mouth advocacy further boosting momentum.

This is why it’s crucial to nurture lasting customer relationships and continuously enhance their lifetime value as it leads to long term profitability.

Equip your teams with strategies for optimizing CLV to build customer organizations that are poised for sustainable success. Keep track of metrics such as recurring revenue contributions, retention rates and acquisition costs compared to lifetime value in order to set goals that drive results.

Ready to elevate your B2B marketing?

We help leading business-to-business brands hit their marketing goals. Get in touch to learn how Altitude Marketing can help you reach your peak performance.