Every SEO professional uses search volume estimates. It’s basically impossible not to. They help prioritize keywords and show stakeholders what users are searching for.

In theory, at least.

When it comes to B2B marketing, the reality of search volume estimates is quite different. Our new research indicates that commercially available estimates – while better than random chance – deviate significantly from real-world results when volumes are small. This is a meaningful issue in the business-to-business marketing space, where it’s common for SEO keyword targets to have only a few dozen U.S. searches each month. And it should force a readjustment of how SEO agencies and content creators evaluate and choose focus keyphrases.

tl;dr: Summary Takeaways

- Commercially available search estimates for low-volume keywords have a significant margin of error.

- Real-world data deviates from estimates by 99% on average.

- The majority of estimates are low, some resoundingly so.

- While search volume estimates cannot be thrown out entirely, they should be taken with a significant grain of salt when monthly searches are less than 500.

Measuring Search Volume Estimate Accuracy

Our methodology for evaluating the accuracy of B2B search volume is simple: We compared estimates from Semrush with real-world data from Google Search Console. Why Semrush? First, it’s our SEO all-in-one platform of choice, and that’s not changing anytime soon. Second, there’s reason to believe that Semrush search volumes are the gold standard for commercially available data. We’re not picking on the tool! It’s pretty great in general, and any other platform is likely to face the same issues.

Our test sample consisted of 87 keywords for which altitudemarketing.com enjoys an average SERP ranking of No. 7 or higher, with 19 or more GSC-measured U.S. impressions in the month of June. This was meant to ensure that our Search Console data captured as close to 100% of total real-world U.S. search volume as possible. (In reality, the GSC data is likely an undercount.)

The goal was to build a reliable set of keywords closely resembling a typical B2B company’s target list. Business-to-business SEO skews toward the long tail – microscopic volumes and niche topics; difficult to estimate. The most valuable and intentful keywords often have monthly search volumes in the tens or low 100s, rather than the thousands or tens of thousands. (Our assumption is that generating accurate estimates for high-volume keywords is easier than with low-volume keywords, as there’s more data to work with.)

Methodology & Datasets

Our sample keyword list covered:

- Brand terms (e.g., Altitude Marketing)

- Commercial intent (e.g., rebranding agencies, SEO for industrial companies, life science digital marketing agency)

- Informational content (e.g., how to market IT services, focus keyphrase example)

The mean Semrush U.S. search volume estimate was 93. The median was 50. The lowest estimate was 10 (seven terms), and the high was 590 (for “IT marketing”). Semrush data was pulled on Aug. 11, 2023, and was compared to GSC data from June 2023 (picked for recency and to avoid the July 4 holiday).

Search Volume Estimates vs. Real-World Impression Data

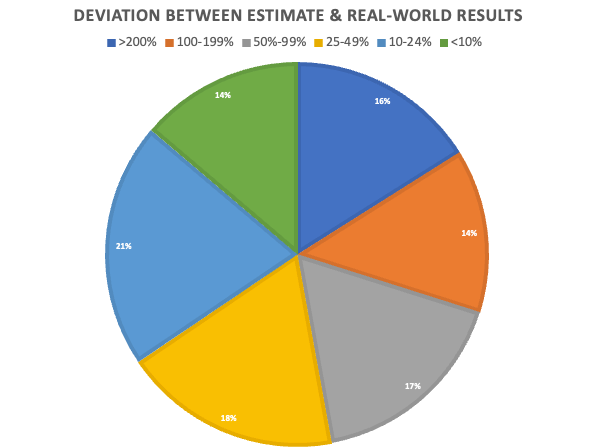

In general, our results showed significant variance between monthly search volume estimates and real-world impressions. On average, search volume estimates deviated from actual data by 99%, with a median deviation of 46%.

- Only one term out of 87 (“product launch phases”) exactly matched its estimated volume (30).

- Twelve terms showed a percentage deviation of less than 10%. For example, “integrated marketing firm” returned 241 impressions on an estimate of 260 (7% low), and “focus keyphrase examples” saw 153 impressions on an estimate of 140 (9% high).

- Only 16 terms showed Semrush volume estimates higher than real-world impressions. Seventy-one showed estimates lower than what was actually seen. The most extreme deviations were on this end of the scale, such as “life sciences digital marketing agency” (10 estimated, 69 returned), “integrated SEO” (90 vs. 463), and “B2B SEO trends” (20 vs. 81).

- U.S. search volume estimates for 26 of the 87 terms were half or less of real-world results. In other words, 30% of targets received more than twice as many monthly searches as Semrush estimated, with 13% receiving more than four times as many searches as predicted.

- Since it’s probable that altitudemarketing.com did not receive 100% impression share for every term, real-world volumes likely deviate more than our results indicate.

Our results do not show any clear pattern of which terms are overestimated and which are underestimated. For example, one can posit a close relationship between “scientific marketing agency” (30 estimated, 25 real-world) and “life science marketing agency” (320 estimated, 515 real-world). It’s likely safe to assume, then, that the significant deviations seen between estimated search volume and actual impressions are a product of the inherent unpredictability of small data sets.

So, what does that mean for B2B marketers?

The Impact of Search Volume Estimate Deviation

To be clear, our results do not demonstrate the worst-case scenario – that search volume estimates are worthless. A degree of correlation between estimate data and real-world results exists, and it’s likely that estimates become markedly more accurate as search volume increases. However, at low volume, correlation between estimate and real-world results can vary significantly (with a bias toward underestimation).

It’s not reasonable to say search estimates shouldn’t be used at all for low-volume keywords. SEOs need something beyond gut instinct to prioritize their target lists, and the data is baked in to every SEO workflow. However, estimated volumes need to be taken with a grain of salt for micro-keywords. Deviation and variance are simply too high to say confidently that a term with an estimated 100 searches each month is definitely more valuable than 30. The real-world volume for the term with 100 estimated searches could easily be as low as 50, while the term with an estimated 30 could really return 60. This throws a wrench in traditional prioritization, creating parity between terms that – on paper – differ by more than 3X in value.

This represents a marked change from SEO chapter and verse, which has long relied upon monthly search estimates as critical decision-making data. But when volumes are small, the data points elsewhere. SEO professionals would be far better served by putting an understanding of the subject matter and user ahead of the easy out of “the numbers the tool spit out.” Below a few hundred searches, the estimated volume numbers alone are not enough to make a prioritization decision. The winner should be the one more potentially valuable to the business, since which one actually gets searched more is effectively unknown.